The Great Decoupling

Traffic and pipeline no longer move together. I’ll show you how to deal with it.

Last week, I announced that all posts older than 4 weeks will now be gated. You can upgrade to Premium for the full archive, research, frameworks, and templates.

Growth Memo Premium is trusted by top growth leaders and operators navigating AI search in real time. Sent to 23,862 subscribers. Welcome to +163 new readers.

SEO died as a traffic channel the moment pipeline stopped following pageviews. Traffic is either down for many sites, or its growth nowhere near reflects growth rates of 2019-2022, but demos and pipeline are up for brands that shifted from chasing clicks to building authority.

What you’ll get in today’s memo:

Why traffic and pipeline decoupled

What brand strength actually means in AI search

How to reframe SEO with executives

This week, premium subscribers also get the Brand-SEO Scorecard - a measurement framework to diagnose whether your SEO strategy is positioned for traffic or brand influence - and a 30-day action plan to transition to a brand-SEO focus.

Be first everywhere customers search

For businesses, visibility means more than rankings. Semrush Enterprise empowers brands to own every layer of search.

By unifying SEO and AI search visibility into one platform, you get comprehensive performance tracking, live content scoring, and real-time optimization guidance.

Your teams can swap manual busywork for impactful strategy with advanced automations. And it’s all backed by the market’s leading search database.

It’s how leaders become dominant across both search engines and AI.

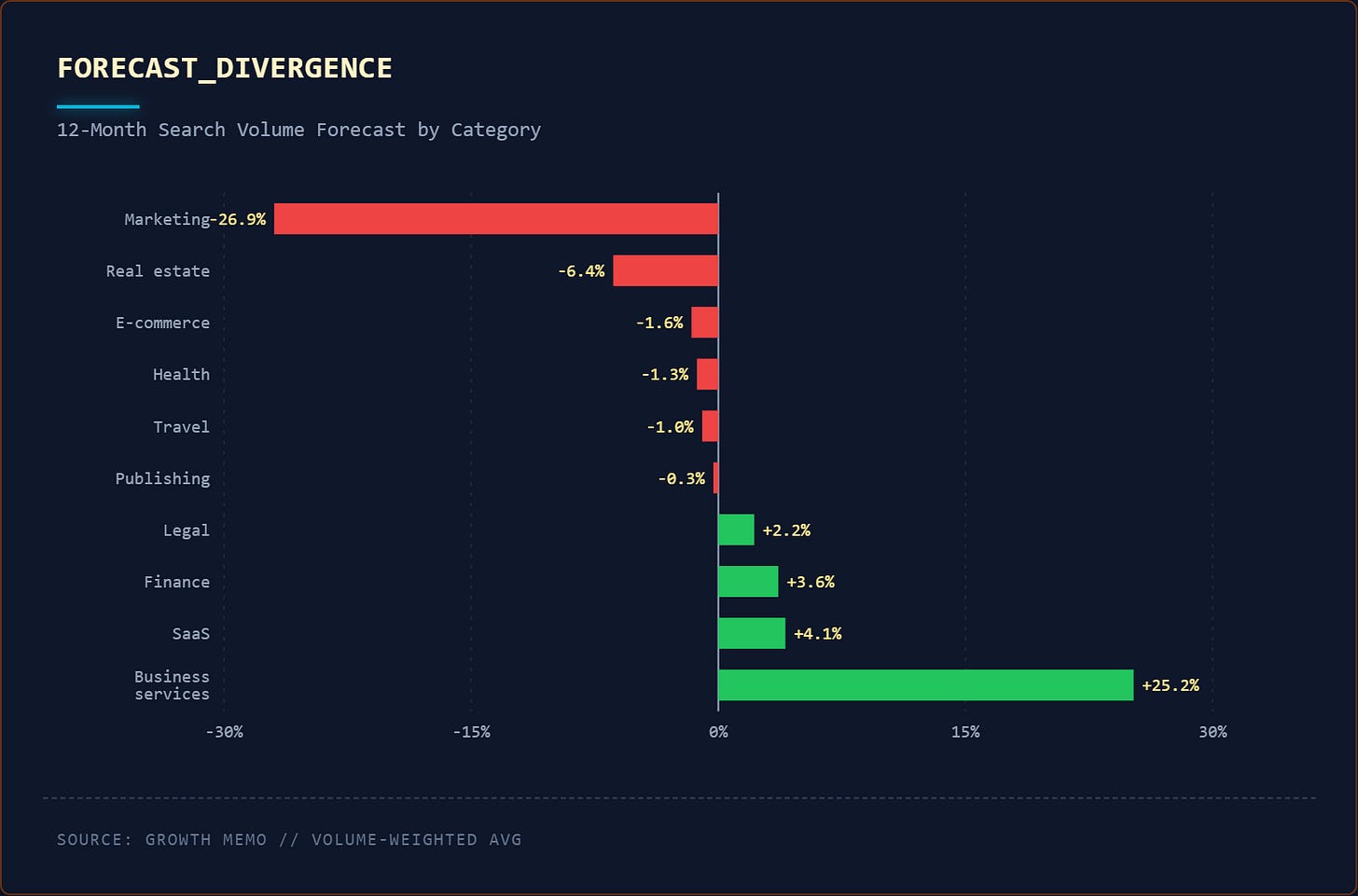

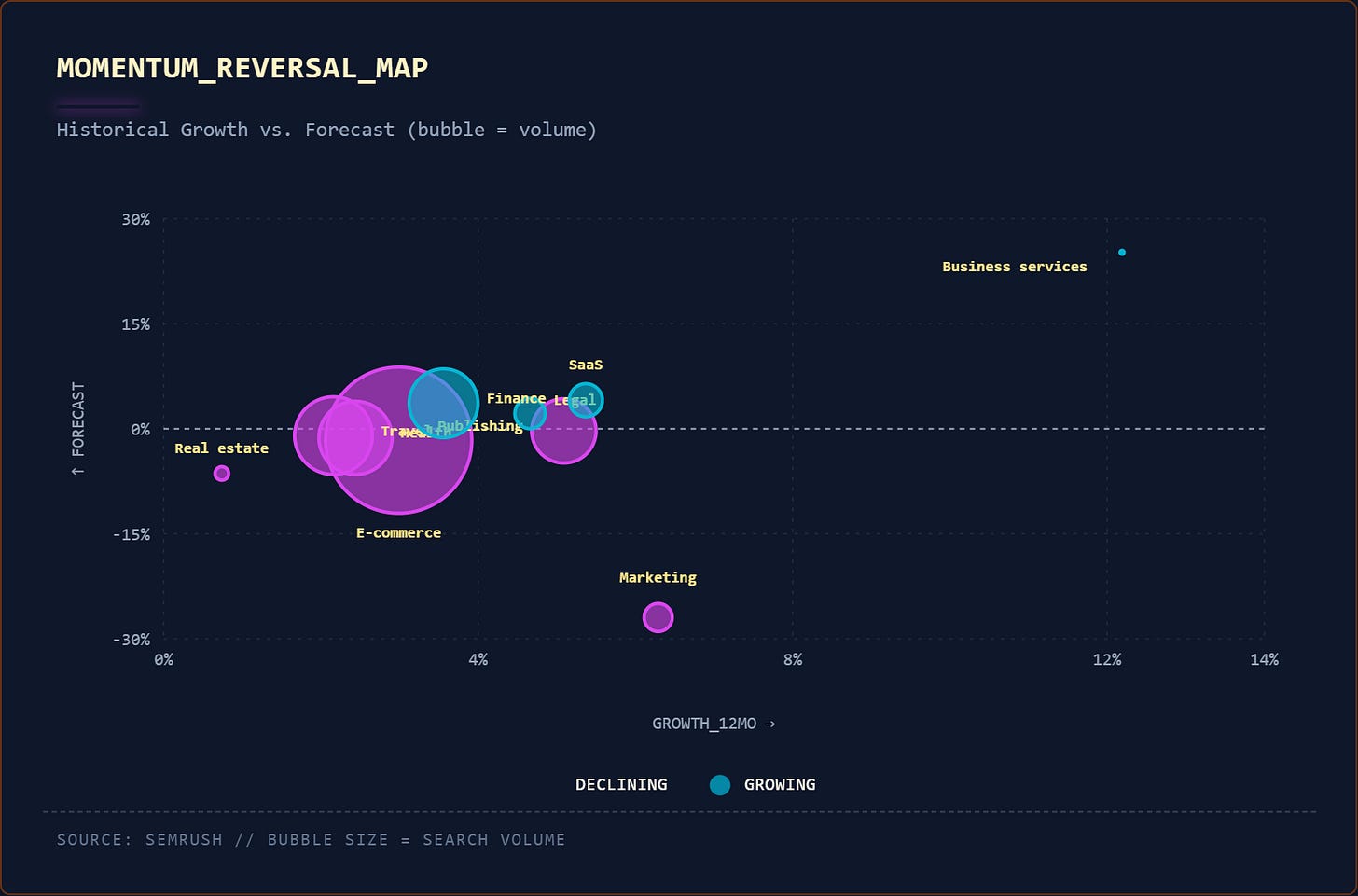

1. We’ve hit peak search volume for traditional queries

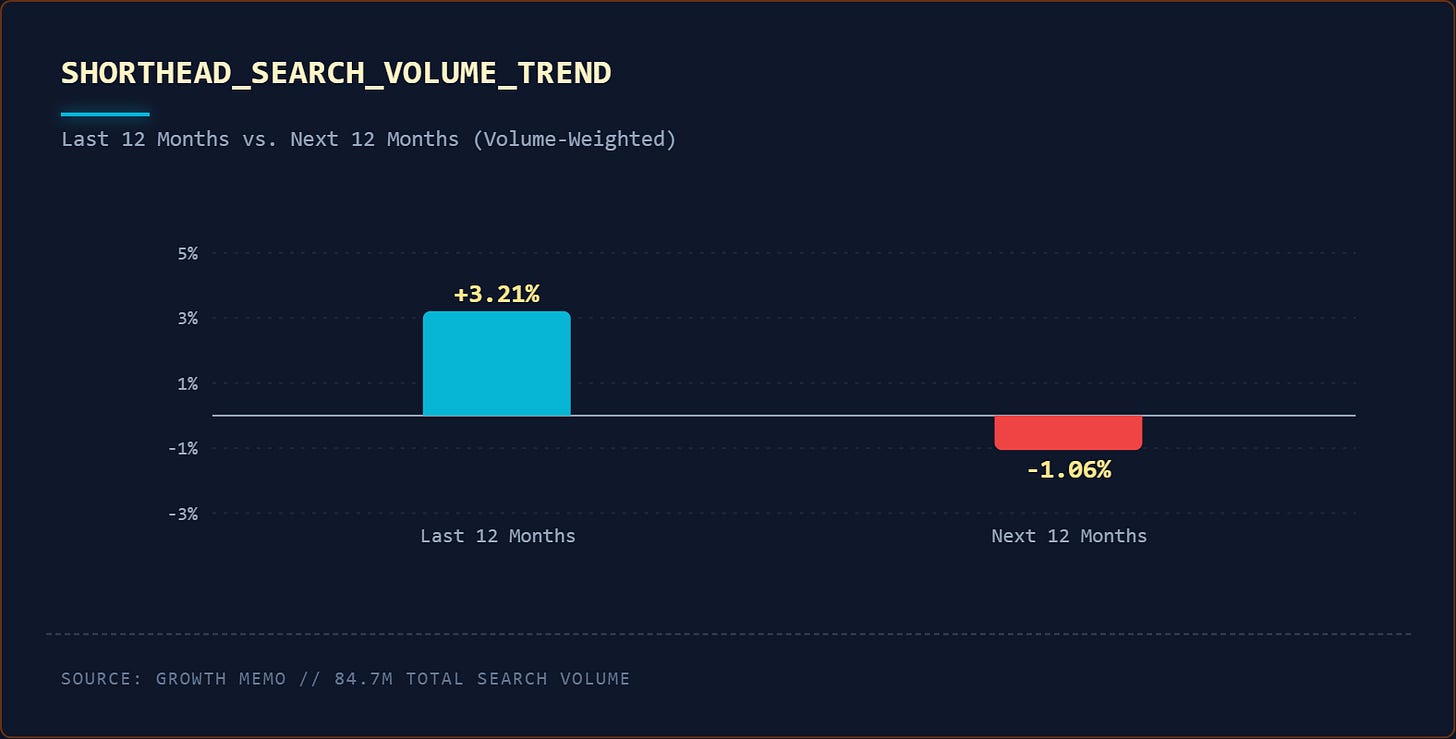

Short-head keyword demand is in permanent decline and likely contributing to slowed traffic growth or decline.

An analysis of roughly 10,000 short-head keywords shows that collective search volume grew only 1.2% over the last 12 months and is forecasted to decline by 0.74% over the next 12 months.

Two forces are driving it:

Fragmentation into long-tail: demand did not disappear, it atomized into thousands of specific queries.

Bypass behavior: more users start in AI interfaces (AIOs, AI Mode, ChatGPT) instead of classic search.

This shift is irreversible for 4 structural reasons:

1/ AI Overviews are here to stay. Google’s revenue model depends on keeping users inside the SERP. Zero-click search protects Google’s ad business. The company is not reverting to the 10 blue links.

2/ LLM outputs are preferred starting points. Many users have conditioned themselves to expect direct answers. The behavior change is complete.

3/ Zero-click is now the default expectation. Clicking through now feels like friction, not value. If the answer or solution isn’t easily acquired, the search experience failed.

4/ Content supply exploded. There is significantly more content competing for the same queries than 3 years ago. AI-generated articles, Reddit threads, YouTube videos, and newsletters all compete for visibility. Even if visibility or “rankings” hold, CTR collapses under the weight of infinite options.

Optimizing for traffic growth in this environment is like optimizing for fax machine usage in 2010. The channel is structurally shifting - the products that people use to find answers have fundamentally changed.

2. Traffic and pipeline decoupled because AI ate the click

The correlation between organic traffic and pipeline has broken. But it takes a bit more work to convince stakeholders and executives. We’re seeing this across the industry.

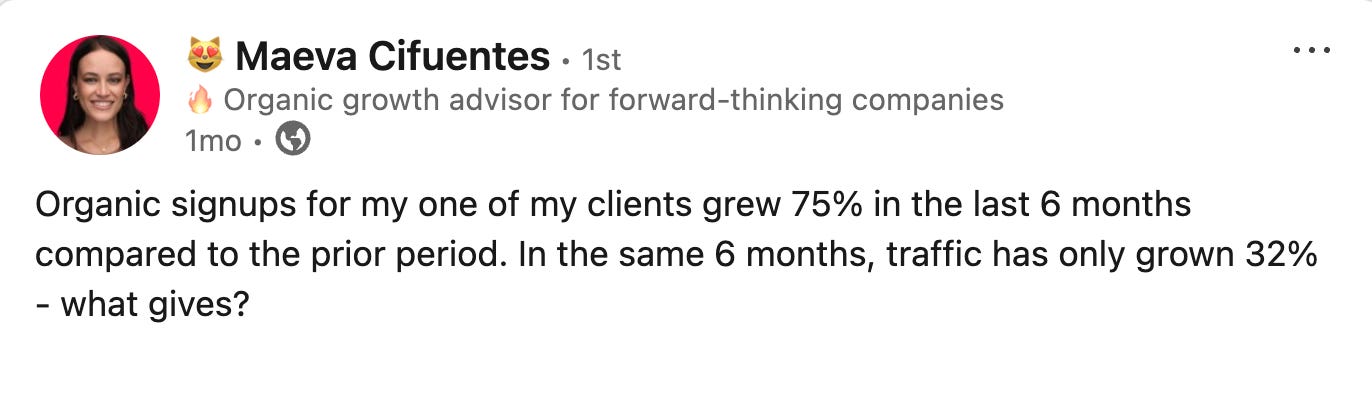

In December, Maeva Cifuentes reported traffic growth of 32% for one of her clients, while signups grew 75% over the same 6-month period. Her post was in response to one from Gaetano DiNardi, who found no correlation between traffic and pipeline across multiple B2B SaaS companies he advises. Maeva’s client data shows you can grow pipeline 2.3x faster than traffic. Gaetano’s data shows you can grow pipeline while traffic stays flat or even declines.

The classic SEO model assumed a linear relationship: More rankings meant more clicks, more clicks meant more traffic, more traffic meant more leads.

Alternatively, AI answers queries without sending clicks. The Growth Memo AI Mode Study found that when the search task was informational and non-transactional, the number of external clicks to sources outside the AI Mode output was nearly zero across all user tasks. Users get the information they need - directly in their interface of choice - without ever visiting your site.

But buying intent didn’t disappear with the clicks.

SEO creates influence. It can still shape which brands buyers trust. It just doesn’t deliver the click anymore.

Education happens inside the AI interface. Brand selection happens after. Your traffic vanished, but the demand for your product/services didn’t.

This explains why Maeva noted she has clients whose traffic is declining but demos are growing by double digits month-over-month.

The SEO work didn’t stop working. The measurement broke. Teams optimized for clicks are being judged on a metric that no longer predicts business outcomes.

3. Strong brands still win in AI search, but “brand strength” has a new definition

In AI search, performance depends less on “more pages” and more on whether AI systems can confidently understand, trust, and cite you for a specific audience and context.

Brand strength in AI search has four components:

Topical Authority: Complete ownership of the conceptual map (see topic-first SEO), not just keyword coverage.

ICP Alignment: Answers tailored to specific buyer questions, prioritizing relevance over volume. Read Personas are critical for AI search to learn more.

Third-Party Validation: Citations from category-defining sources matter more than high-DA links (see the data in How AI weighs your links).

Positioning Clarity: LLMs must recognize what a brand is known for. Vague positioning gets skipped; sharp positioning gets cited (covered in State of AI Search).

SEO teams that are structured for traffic optimization are now misaligned with business outcomes.

The conversation you need to have is “traffic and pipeline decoupled, here’s the data proving it, and here’s what we’re measuring instead.”

Move from keyword-first workflows to ICP-first workflows. Start with ICP research (what questions do your buyers ask and where do they ask them), positioning (what are you known for), and omnichannel distribution (SEO + Reddit + YouTube + earned media). SEO is no longer a standalone channel. It’s one input in a brand-building system.

Move from traffic reporting to influence reporting. Stop leading stakeholder conversations with sessions, impressions, and rankings. Report on brand lift (are more people searching for you by name?), pipeline influence (what percentage of demos started with organic touchpoints?), and LLM visibility rates (how often do AI systems mention your brand vs cite your content?).

4. The uncomfortable question: If SEO doesn’t drive traffic anymore, what does it do?

Here’s what SEO actually does and always did: It shapes mental availability and brand recognition, builds topic/category authority, frames the problem (and the solution), and reduces buyer uncertainty.

Traffic was a proxy for those things. The click was the observable action, but the trust was the outcome that mattered.

LLM-based search has removed the click but kept the trust-building. Users still learn from your content. It just happens inside an LLM interface instead of on your domain. Your content can still influence which brands buyers trust. Yes, it’s harder to measure because it’s invisible to analytics. But the outcome - buyers choosing your brand when they’re ready to buy - is the same.

SEO influences brand preference within the category. When buyers are in-market and researching solutions, SEO determines whether your brand is in the consideration set and whether AI systems recommend you.

Traffic was never the point. It was just the easiest thing to measure.

5. What to do in the next 30 days

This week, premium subscribers get the playbook for moving from traffic-first to pipeline-first, including:

The Brand-SEO Scorecard: An 8-metric diagnostic with industry benchmarks.

A 30-Day Action Plan: How to execute the pivot.