SEO funnel shows the full path from the creation of pages on a website to getting organic traffic.

404s, duplicates, load time, non-canonicals, JavaScript errors, backlinks, content creation - these all can be important but not impactful on traffic growth. Sounds familiar? Happens all the time!

Please welcome SEO funnel - a brand new report that reveals the most impactful things to do first!

SEO funnel reflects the state of things of a website on the main stages of organic traffic growth.

SEO funnel lets you understand the most critical works that you should start with to get positive dynamics in SEO

Now you will know what pages are "dead" in terms of SEO and what to change so they get ranked.

It all saves you a lot of time to understand it. Most importantly, you will spend SEO resources on optimizations, which will bring you new organic traffic, not just SEO works for SEO works.

Welcome to a demo to get a free trial at jetoctopus.com

You will be impressed.

👉🏻 Book a demo and get a free trial.

All eyes are on AI, but some of the biggest changes in Google's ecosystem happen in shopping.

Google's logistics journey

Google attempted to get into logistics but failed.

Now, they have to push merchants and retailers to highlight their capabilities to deliver quickly at low prices.

In 2015, Google Express delivered groceries and other goods in select locations, eventually bringing products to customers within 2h. A year later, Google retired grocery delivery but still fulfilled other products. In 2019, Google shut delivery down altogether and instead focused on Google Shopping.

At the time, the thought wasn't ridiculous at all that Google could build a strong logistics arm. Just think about Google Maps and the data that comes with it: ideal routes, traffic, etc. So, what happened?

Google saw the signs on the horizon, but it was too late.

First, Amazon already shipped the next day when Google was still working on 2 days. Amazon Prime already offered Prime Reading, Audible Channels, Twitch Prime, Music, and 1h + 2h delivery in 2016. Amazon's brand and Network Effects were so strong that the share of purchase journeys starting on Amazon jumped from 44% in 2015 to 55% in 2016, while Google's dropped from 34% to 28%.1

Second, logistics partners like Target or Walmart built their own shipping capabilities. In 2019, Walmart started offering InHome delivery and Target one-day shipping.

In classic Aggregator fashion, Google refocused on what it does best: software. Google doesn't just have Maps and its data to optimize routes but also sells the necessary cloud infrastructure.

Google's Last Mile Fleet Solution:

Last Mile Fleet Solution is available to help fleet operators create exceptional delivery experiences, from ecommerce order to doorstep delivery. The solution allows your business to optimize across every stage of the last mile delivery journey: capturing valid addresses, planning delivery routes, efficiently navigating drivers, tracking shipment progress, and analyzing fleet performance. Last Mile Fleet Solution provides reliable infrastructure that scales with you as your business grows–all with predictable pricing per delivery. It builds on one of our existing mobility solutions, On-demand Rides & Deliveries, which is used by leading ride-hailing and on-demand delivery operators around the world.2

Amazon's logistics network is massive in size and a lever to form stronger customer relationships. In 2020, it passed FedEx. In 2023, it passed UPS and is now the largest delivery and freight business in the US.3

Where Amazon owns the value chain by building its own delivery network, Alphabet aggregates 3rd party logistics providers through Maps and GCP (and maybe Waymo in the future?). Now, what's left is aggregating the other end of the market: shoppers.

New shopping ranking factors

Google has no option other than turning shopping search into a marketplace if it wants to compete with Amazon. Google needs to become a shopping destination in itself, and they do it in 3 ways:

First, Google significantly localized the SERPs over the last few years, and its power in local search is unmatched.

From Local Search is Google’s weapon against Amazon:

Google recently rolled out a lot of product features to push its competitive advantage in Local Search:

Inventory schema to show whether a product is available for retail purchase

Trusted store badges for stores with good customer service

Delivery time for products

All of these new features build a landscape that makes it easier for users to find and buy from local stores. Users might not want to buy everything online, even though the total share of online sales is steadily growing.

But that alone is not enough to win e-commerce.

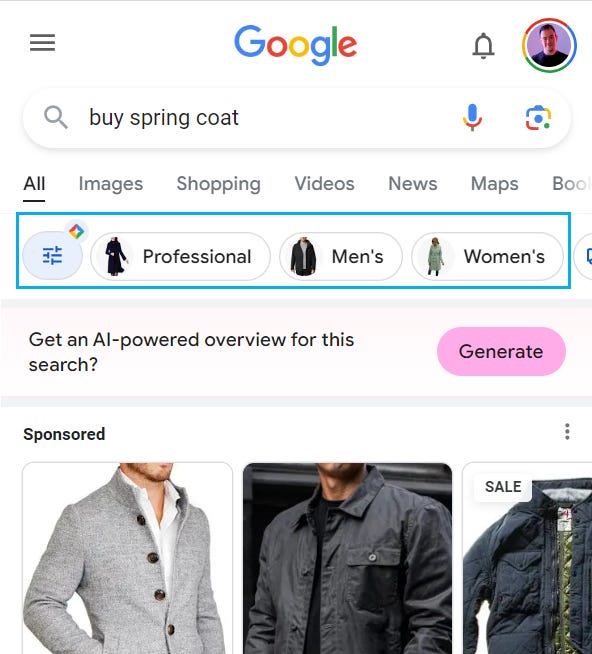

Second, when a query indicates that users are looking to shop, the desktop search results show product filters and organic carousels - basically a shopping feed. With Buy on Google, shoppers get from the search results to the merchant checkout. Marketplace transformation: complete.

If more people use product filters to find specific products, which I assume is the case since Google shows them significantly more often, should merchants still care about duplicate content or simply recreate all facets Google shows in product filters?

Third, instead of developing its own logistics network, Google competes with Amazon's delivery moat by giving merchants more visibility in organic listings when they meet high price and shipping expectations. The result is a new set of factors that decide whether merchants sell on Google or not. Call them ranking factors at your own risk!

Return of the 4 P’s

Organic results still get clicks, and ranking #1 for a shopping term is still valuable, but new features inflate the value of classic Blue Links. Organic Listings are a completely new playing field that doesn't operate on the old rules. The new rules put product and Go-To-Marketing decisions further in the background than search optimization:

Blue Link ranking factors: backlinks, technical SEO, on-page content

Organic listing ranking factors: price, discounts, availability, shipping speed, customer reviews, images, validated merchant

What does this remind you of? The classic Marketing Mix! The 4 P's: price, product, promotion, place!

Invented in the 50s, the Marketing Mix is a list of 4 key decisions companies can make about a product to maximize sales, and we're seeing a strong comeback in Google Shopping:

Price

Old definition: supply chain cost, marketing cost, margin, retail markup, perceived value

New definition: supply chain cost, CAC, shipping, margin

Product

Old definition: who needs it and why?

New definition: good reviews = people you want to sell to

Place = shipping

Old definition: where you sell (brick & mortar)

New definition: shipping speed, returns

Promotion = discounts

Old definition: advertising, PR

New definition: discounts, PLAs, thumbnails

How much longer is Google showing blue links vs. organic product carousels? My prediction: by the end of this year, we’ll see the first shopping verticals that don’t show blue links anymore. That’ll be a death blow for price comparison sites and affiliates.

Given the growing importance of product and shipping decisions on organic visibility, companies face the challenge of bringing many functions together and quickly responding to distribution changes and challenges.

Does brand value also matters in shopping feeds?