Can Network Effects replace Performance Marketing?

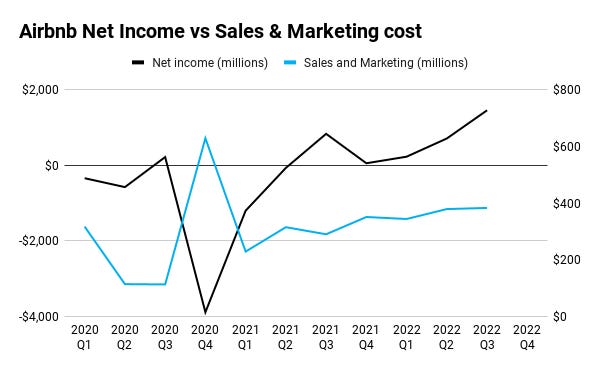

Airbnb crushed the third quarter of 2022. Bookings reached almost 100M and increased +25% year-over-year with a +42% improvement in net income margin.

On the call, CFO David E. Stephenson called out a strategic pivot (bolding mine):

In terms of the active bookers, taking a step back and look at the marketing approach that we've had since pre-COVID and that we really has accelerated in COVID and since, has been to continue to focus on the overall brand of Airbnb and to be less reliant on search engine marketing.

For context: Airbnb got a lot of media coverage for lowered paid search investments in 2019.

Airbnb Inc. said its strategy of slashing advertising spending, investing in brand marketing and lessening its reliance on search-engine marketing is continuing to pay off. […] The company in 2019 began trying to depend less on search advertising and to lean more on broad marketing campaigns and public relations designed to build its brand. (WSJ)

However, 3 reasons lead me to the conclusion that instead of a genius marketing play, it’s much more likely Airbnb’s network effects make performance marketing redundant.

As a result, network effects can replace performance marketing but only for marketplaces due to their innate Network Effects.

Airbnb grew even without performance marketing

Airbnb saw business growth during the pandemic (except for Q4 2020) even though performance marketing investments had already been significantly lowered. When looking at the graph in the intro, you can see that the summer quarter (Q3) in 2020 performed better than Q1 and Q2.

To be precise, Airbnb didn’t lower paid search marketing spend in 2019 but in April 2020 when the pandemic broke out (from $6.6M in March to $30K in April).

It was nonbranded paid search that dropped in November 2019 (see graph below) while brand bidding continued.

These two trends together, improving bookings while search ad spend dropped during the pandemic, led me to the conclusion that Airbnb learned its business can operate - even thrive - without performance marketing.

Other marketplaces employed the same strategy

Booking, Airbnb’s true rival, also lowered performance marketing spend but didn’t get as much media coverage.

Is Airbnb’s strategy to replace performance marketing with more PR in itself PR 😉?

Booking is a marketplace between hotels and travelers, just like Airbnb is a marketplace between hosts and travelers. Initially focused on hotels, Booking started listing rental homes and apartments in 2018 to compete directly with Airbnb.

When Uber turned off ⅔ of its ads, cutting $120M of its $150M budget, they noticed no difference in results. In fact, they learned organic listings caught the majority of paid app installs (source: Linkedin). The same happened to eBay in 2012: when shutting off branded paid search, they learned that organic compensated for paid traffic (source). Zero channel incrementality.

Booking, Uber, and eBay are marketplaces with strong Network Effects that can outpower performance marketing by a long shot. When travelers book a stay with Airbnb or a ride with Uber and have a good experience, they talk about it and come back. At the same time, more travelers/riders attract hosts and drivers. Network Effects are the result of aggregation: superior user experience attracts demand (travelers, riders, buyers), which commoditizes supply (hosts, drivers, sellers).

Marriott, the largest hotel chain in the world by the number of rooms, is an excellent counter-example to show why marketplaces should not lean on performance marketing (except for kickstarting) but leverage their Network Effects. They ramped up paid search spend in mid-2019, lowered it during the pandemic, and increased investment in the summer of 2021, while Airbnb and Booking never ramped back up again.

Marriott has no other option, though. The proof is in the results: Marriott’s Q3 2022 earnings show a +35% increase in revenue YoY.

SEO is a much stronger lever for marketplaces

Marketplaces are aggregators and prone to grow through SEO. Airbnb benefits from a strong brand that drives heavy branded organic traffic but is also able to drive decent non-branded organic traffic.

Airbnb’s co-founder and CEO, Brian Chesky, highlights the importance of direct traffic, typically the result of strong brand search demand and Network Effects:

[...] we don't really think of marketing as a way to buy customers because obviously, as we mentioned, more than 90% of our traffic is direct or organic. (Q3 2022 Earnings call)

The data supports brand traffic growth: brand search volume has grown steadily over the last 6 years, even during the pandemic (see screenshot below).

Airbnb’s organic brand traffic reached 17.5M monthly visits in May 2022. Even at its height in May 2019, paid search only drove 6.1M monthly visits for a cost of over $10M (according to Semrush).

I assume Airbnb learned about the value of SEO when the pandemic forced lower ad spend. As ever so often, companies don’t realize the value of SEO until they turn paid channels off.

Airbnb’s non-branded organic traffic grew from 1M visits a month in March 2020 to 3M in May 2021. Since March 2022, organic traffic has been flat to down. Why? Because Airbnb launched a search-unfriendly new category strategy without static URLs. SEO traffic dropped below 2M in November 2022.

Booking shows even stronger non-branded organic traffic, making the company less reliant on performance marketing than Airbnb (see screenshot below). Maybe that’s why Booking’s number of nights booked grew by +32% Year-over-Year (more than Airbnb’s).

Booking's organic brand traffic reaches 2M visits monthly, a much as Airbnb’s non-branded organic traffic.

Marriott gets over 35M monthly visits from branded searches and around 2M from non-branded searches. If one of the three brands (Airbnb, Booking, Marriott) could rely on brand traffic, it would be Marriott. However, Marriott is the only company that increased performance marketing spend, and I argue it's because of missing Network Effects.

Macro factors accelerated Airbnb’s Network Effects

Airbnb’s detachment from performance marketing is largely the result of Network Effects, as shown by its growth during the pandemic, marketplace competitors following the same strategy, and SEO traffic. So, what drove Airbnb’s strong Q3 2022 earnings? Post-pandemic behavior and the recession.

2022 was a strong travel year that blew classic seasonality out of the park. After 2 years at home, people were keen to compensate for the pandemic and travel again. The result is a big demand wave for Airbnb.

At the same time, the recession of 2022 (GDP was negative in Q1 and Q2), growing fears of an even larger recession and sustained high inflation moved more people to consider renting out (parts of) their homes. The Q3 2022 earnings announcement specifically calls out growth of the number of new hosts: “Second, we’re seeing strong growth in the number of new Hosts on Airbnb. Just like during the Great Recession in 2008 when Airbnb started, people are especially interested in earning extra income through hosting.”

The basis for Network Effects, of course, is a superior user experience. Or, in plain terms, strong product-market fit. CFO David E. Stephenson (again, on the Q3 2022 Earnings call: “The people that are willing to kind of travel right now and experience Airbnb are really sticky, and the cohorts are as strong, if not stronger, than we saw previously.”

Airbnb’s challenges in the future

Network Effects, the result of Airbnb’s excellent product, put the company in a good position for the future. But it faces two challenges.

The first is Google’s travel integration, which gets a lot of attention and clicks for important search terms for Airbnb.

The number of integrations for Airbnb’s organic keywords has grown steadily since the pandemic started (see screenshot below). Airbnb executives also called this trend out in the Q1 2021 earnings call. However, competitors face the same issue.

The second challenge Airbnb faces is the negative effect of ATT on brand marketing. In 2022, we’ve seen the revenue decline of big brand advertising platforms like Meta, Snapchat, and Youtube due to Apple’s Tracking Transparency. If Airbnb wants to lean more on brand marketing, channels like OTT (over the top, think: Netflix & Co) and OOH (out of home, think: billboards) are more suitable channels.

To face competition from Google and ATT, Airbnb’s best bet is its Network Effects and Marketing Through People - and Chesky knows that.

Chesky with the full quote from the intro:

And I'd just say, just to jump in, I mean we don't really think of marketing as a way to buy customers because obviously, as we mentioned, more than 90% of our traffic is direct or organic. And so the main thing is we take a full funnel approach to marketing and actually the top of the funnel is PR and communications. And we think that's one of the biggest drivers of our traffic is PR and then brand marketing is actually important. And actually, we think of it more like product marketing. We want to educate people about our new futures.