The state of ecommerce SERP Features

What SERP Features matter most for ecommerce? How can online stores use them to their benefit or when to pivot their keyword strategy?

Ecommerce has gone through a massive expansion and contraction over the last 2.5 years with significant consequences for the global economy. The e-commerce search results are also seeing tectonic shifts since Google announced new shopping experiences in 2021. [1]

To understand the shopping space better, I analyzed 20,000 e-commerce keywords and what SERP Features Google uses to enrich the organic results. In the previous article, I looked at the landscape of Google's first-page results on Desktop. In this second article, I explain what SERP Features Google shows in e-commerce, how you can use them to their benefit and when to pivot your SEO strategy.

Study methodology

The study is based on 20,000 e-commerce keywords. I looked at the following SERP Features:

Ads (regular)

Product Listing Ads (PLAs)

Map packs

Top stories

Image carousels

Related searches

Query refinements

In the previous post, What 20,000 keywords say about Google’s first page, I cover:

Number of organic results

Query length

Zero-click searches

Search volume

Keep in mind that all data is for Desktop searches only. This is impoManycause the search results look increasingly different on separate devices. A lot of Desktop SERP Features have been live on Mobile for a while.

Which domain appears most often for position 1?

The analysis features over 17,000 domains. Chinese mass manufacturer Shein is the most interesting among the top 20 domains that rank for most keywords. The company grew rapidly with an aggressive social media advertising strategy but now leaves revenue on the table with its search-unfriendly site architecture.

Amazon is unsurprisingly leading the charge, ranking for over 18% of keywords and capturing almost 20% of total search volume. The 2nd place comes in with a long distance: Homedepot with 4.63% of top ranks, followed by Wayfair and Walmart.

Google captures almost 1% of ecommerce queries with term definitions in the SERPs. Youtube is at only 0.9%, but I expect them to gain more search market share over time as Google displays more videos in Search.

Ads and Product Listing Ads

The analysis shows that one basic rule remains: if you want to appear at the top of the search results, you have to pay.

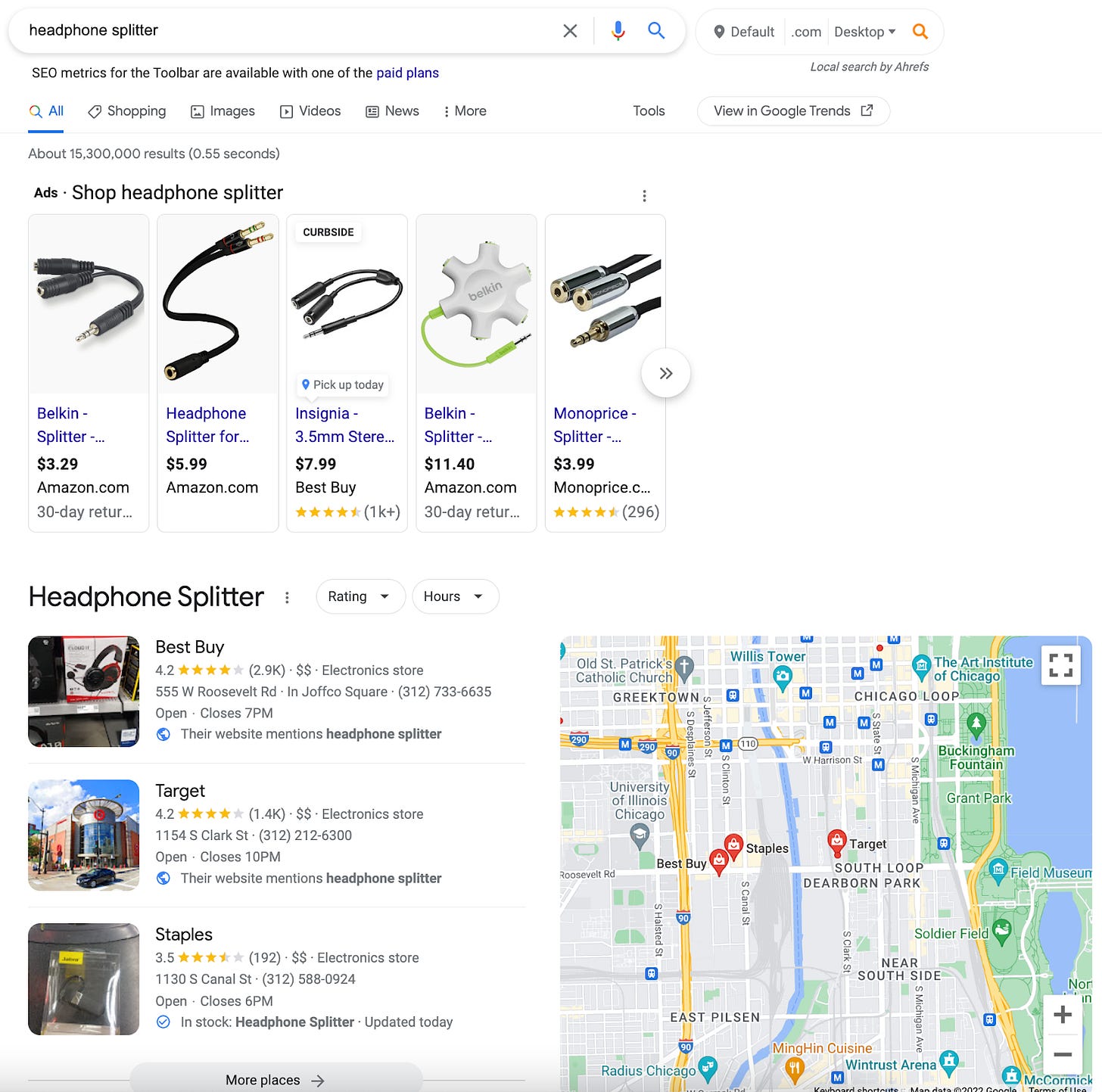

Google shows top ads for 63.8% of the 20K ecommerce keywords I analyzed. That might seem low at first, but consider that ecommerce is better suited for a more graphical ad format: Product Listing Ads (PLAs). Product visuals are key for shopping, and Google provides features like "in store", reviews, and shipping details that help the ads stand out even more.

The % of pages with a certain number of results vs. top ads

The relationship between the number of results Google shows on the first page and the number of top ads is strong, with a correlation coefficient of 0.992. In plain terms, the more results appear on the first page, the more likely Google shows top ads. More about why that is in a moment.

However, search volume and top ads have an inverse relationship (correlation coefficient: -0.471). The lower the search volume, the more likely it is for top ads to show up. Keywords with high search volume tend to have a more ambiguous intent and Google shows more SERP Features to satisfy all possible intents. This theme stretches throughout the whole analysis and also explains the strong negative relationship between zero-clicks and top ads (-0.851).

Google shows different combinations of top ads and PLAs:

Top ads only

PLAs only

Top ads + PLAs

I found that PLAs have a stronger impact on zero-click searches than top ads:

Average zero-clicks searches w/o ads, w/ PLAs: 66.8%

Average zero-clicks searches w/ ads, w/o PLAs: 56.39%

But take this statistic with a grain of salt. The range of zero-clicks for both combinations ranged from 0 to 99%, so everything is possible. And PLAs are very widespread, so don't assume causality between zero-clicks and PLAs. It's possible that the visual nature makes it more attractive for users to click on PLAs or that they have a harder time differentiating them from organic results. But more research is needed to prove that.

Another interesting relationship exists between PLAs and Map Packs.

Maps Packs

It’s no surprise that Map Packs are everywhere in the ecommerce SERPs given that near me keywords are exploding, and local search is Google’s competitive advantage against Amazon.

Google shows a map pack for 77.3% of keywords. Not as high as Product-Listing Ads, but enough to say that they appear for most e-commerce keywords.

Data from 2020 shows that the number of Map Packs in the SERPs increased from 40% to 50% of the time in July 2020.

It’s unclear whether the growth in map packs is related to Covid, the result of more people shopping with local intent or a conscious decision from Google. Either way, it fits into the current Zeitgeist of the local shopping recovery after Covid.

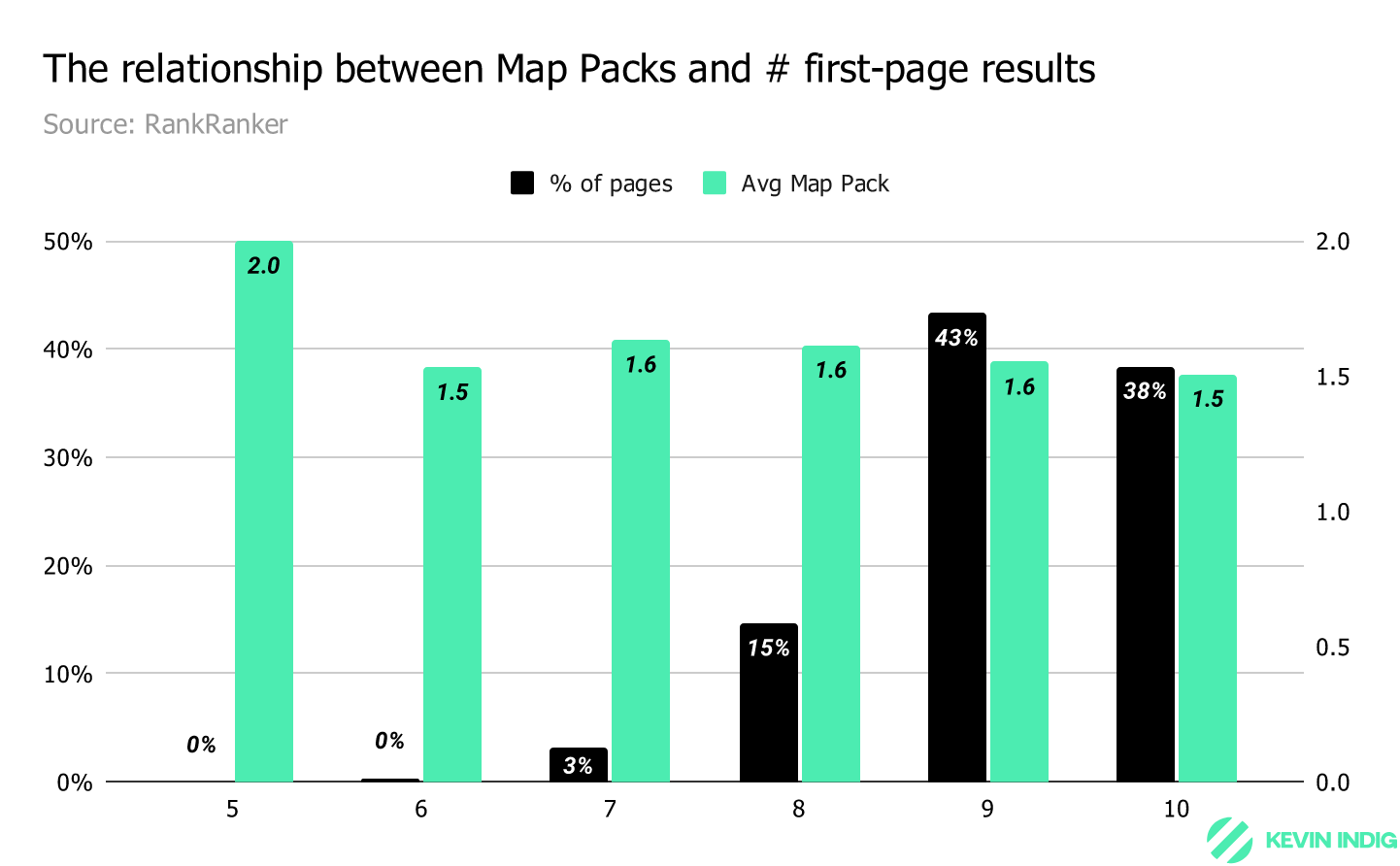

Two relationships stand out when it comes to Map Packs.

First, the more Blue Links Google shows on the first page, the fewer Map Packs appear. The likely reason is that more results amore apparentelated with longer queries and clearer intent. It seems that when Google is unsure about the intent in the ecommerce space, it displays a Map Pack “just in case” the user wants to find a location.

The second relationship is between Map Packs and PLAs. Here, we see a negative correlation coefficient of -0.926, meaning Google tends to show more PLAs when Map Packs are not present and vice versa. This was the strongest negative correlation I found in the data.

There is another SERP Feature that not every online store can rank in, but that can impact sales.

Top Stories

I associate Top Stories more with newsworthy queries than with shopping, but Google shows Top Stories for 15.9% of queries in my analysis. The reason is interesting.

Whereas PLAs and Map Packs tend to appear at the top of the page, Top Stories often make it to the middle when an ecommerce keyword has fragmented intent. For example, Google might show news results about someone defending themselves with pepper spray for the query “pepper spray”, which has a dominant transactional intent. Other examples are “golf cart” or “lawnmower”, which show Top Stories related to accidents.

Since the intent is so different for news searches, Online stores don’t have to worry about Top News pulling clicks away. Many searchers clicking on the Top Stories probably aren't looking to buy a product in the first place.

However, there is an opening for merchants that makes Top Stories very interesting: reviews and inspiration. Google often shows listicles and reviews in the Top Stories module for e-commerce keywords.

Unfortunately, it’s unlikely that the blog of an online store appears in a Top Stories carousel. Instead, merchants should aim to be covered in articles that appear in Top Stories for relevant terms. They can proactively reach out to publications and ask for a mention of their product or invest in PR and building brand awareness, which might lead to inclusion in publisher content.

In the data, I found a negative correlation (CC = -0.516) between the number of first-page results and Top Stories, which indicates Top Stories appear less often for search results with 8 or 9 Blue Links.

I also found a weak negative correlation between Top Stories and query length (CC = -0.291), which hints at pages with more results showing fewer Top stories and showing up for longer queries.

The clearer the user intent, the less likely it is for news modules to show up in ecommerce.

The next SERP Feature is the exact opposite of Top Stories: Merchants need to optimize for it.

Image Carousels

Since 2018, Google has been public about aiming to move the SERPs from text to visuals. Since then, we have seen more iterations and announcements of visual SERP elements. Ecommerce is at the forefront of this trend since product images are so central to the experience.

When Google associates a primarily inspirational intent with a keyword, it shows an image carousel at the top of the SERPs. My analysis shows that image carousels appear 37.4% of the time.

For online stores, the primary opportunity is to rank with product images.

However, when image carousels appear in the middle of the page, they often contain products as well. A click on a product image takes users to Google’s image search, where they find reviews, shipping information and a link to the seller.

Product images are the most powerful way to compete in ultra-competitive search results. I strongly recommend retailers and brands to invest in high-quality visuals. They level the playing field.

The data shows a negative relationship between the number of Blue Links and Image Carousels on Google’s first page, with a strong correlation coefficient of -0.787. Similar to Map Packs, Google tends to show Image Carousels when the user intent is more fragmented.

Two other SERP Features show a similar behavior from Google.

Search Refinements and Related Searches

Google's ad business model optimizes for satisfied searchers and ad clicks. When users are early in their search journey, Google helps them narrow their search further to find what they're looking for in organic or paid results.

Search refinements (or query refinements) and related searches come at the same problem from literally different ends. The former shows up at the top and allows searchers to narrow their search down by brand, location, reviews or category. The latter lives at the end of the search results (with exceptions) and shows the same suggestions in a different format.

When they click a refinement, Google brings searchers to another search page for the corresponding query, e.g., “fan reviews.”

"nearby" refinements also have a strong overlap with the occurrence of Map Packs.

The purpose of the refine/related SERP Features is the same: keep users in the search result and help them explore without clicking through to sites.

Related searches and query refinements have an inverse relationship with a correlation coefficient of -0.816. They don't always occur in the same SERP.

When Google prefers one over the other is unclear. One speculation I have is that it might have to do with entities, and Google shows a query refinement when it has a good idea of all related facets of an entity.

Retailers should keep an eye on refinements and match available category pages with the refinements Google suggests to stay visible as searchers explore. They can serve as inspiration for new queries or topics. As a seller of air purifiers, for example, it might make sense to create a category for “air purifiers for covid”, which shows up as a related search for “air purifiers.”

The results of this analysis boil down to 4 key trends.

The 4 key Search trends in e-commerce

The ecommerce SERPs are undergoing a massive transformation. In my analysis of 20K ecommerce keywords, I noticed 4 key trends:

First, the ecommerce SERPs have become a lot more visual. Image carousels and videos (which are not included in this specific analysis) appear for a significant number of keywords and can attract a lot of attention from searchers. Visuals are not limited to inspiration anymore. Products in image carousels can lead searchers to product landing pages. Online stores need to invest in high-quality product visuals and find ways to make them stand out.

Second, Google shows more SERP Features for ambiguous queries, meaning a search can accomplish several goals. It’s common to see Map Packs, Product-listing Ads, Image Carousels and Top Stories in the same SERP, creating a feed of search modules. That leaves much less attention and real estate for Blue links. Online stores need to aim for rich snippets to compete, optimize for SERP Features and measure how much attention is drawn away from Blue Links by SERP Features.

Third, Shopping on Google is local by default. Google shows Map Packs for the majority of ecommerce keywords as users search for more local stores. For example, more searches for “bicycle shop near me” trigger a Map Pack for the head term “bicycle”. That’s good news for retailers with locations because it opens a new playground on Google Maps. For retailers without a physical presence, however, Map Packs are distractors.

Fourth, visibility is getting more expensive. Google has shown ads at the top of the search results since the early days. Now, PLAs show up for most e-commerce keywords and draw a lot of clicks. As Google is turning more into a feed than a list of search results, more ad slots appear in Popular Products modules, ad carousels, and ad modules that we might not see yet. Online stores can only achieve maximum visibility through a combination of organic results with ads.

More research is needed to understand the impact and opportunities behind other SERP Features like Buying Guides, Popular Products, and video carousels.