The Growth strategies of the top BNPL providers

BNPL providers like Klarna, Affirm, or Afterpay follow specific organic growth strategies that slightly differ and might decide between winner and loser in this winner-takes-it-all game.

I’m privileged to have grown up without debt because my father covered for me. 45 million Americans are not that lucky and graduate with student debt that takes 20 years to pay back on average.

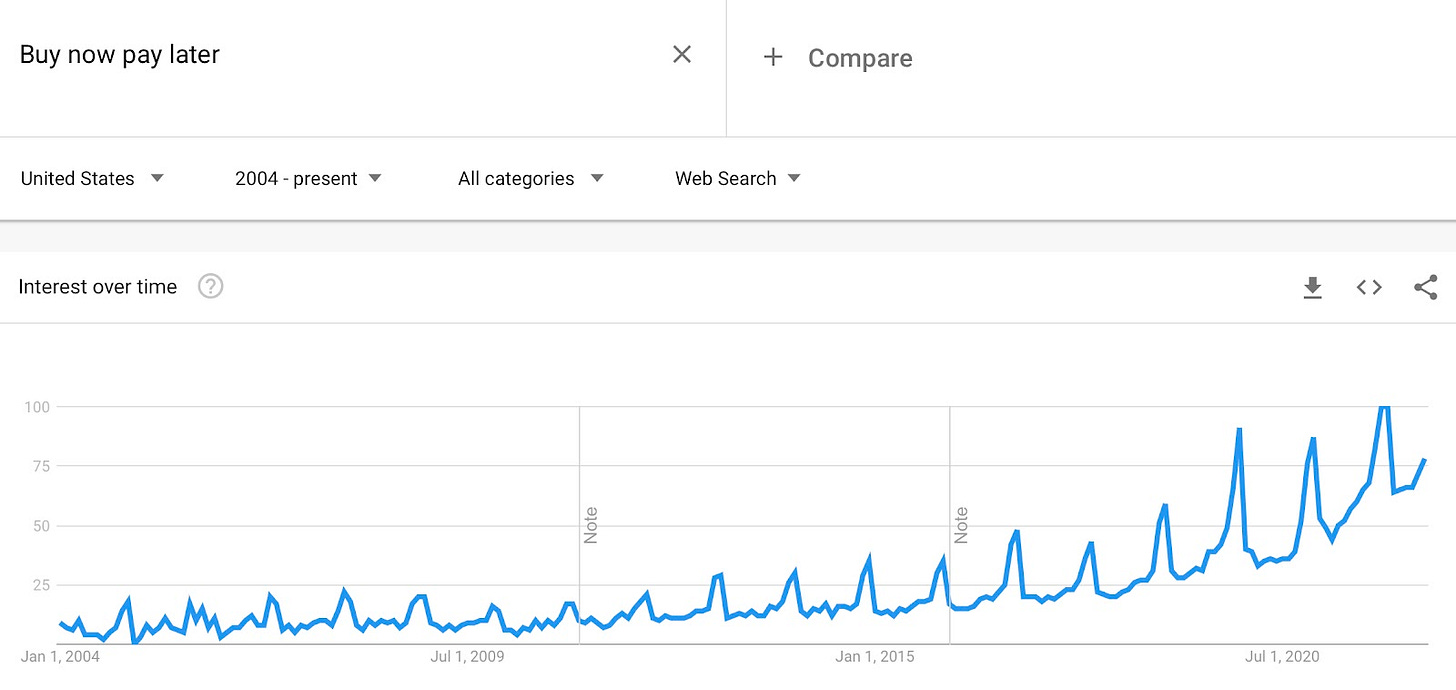

Over the last couple of years, a new consumer debt instrument has come to market that changes consumer behavior: BNPL (buy now, pay later). The way it works is simple. Instead of a single payment, consumers can choose to stretch payment over extended periods of time. They still pay the full price but not all at once. The idea is to take friction out of purchasing and make large sums appear smaller and affordable. Customers can buy any type of goods with BNPL, from fashion to electronics and even medical expenses.

BNPL providers don’t charge consumers but take a cut from retailers and merchants. They’re basically mega affiliates and credit lenders in one. They do silent credit checks and gather more data about the financial credibility of their customers over time.

In total, almost 30 million Americans have purchased at least once using BPNL and most of them are in the lower income class. Over 10% of people who live paycheck-to-paycheck have used it at least once over the last 12 months. That’s one of the problems with BNPL: it’s mostly used by either unresponsible consumers or those who can afford it the least. [1]

The largest and best-funded players on the market right now are Klarna, Affirm, and Afterpay. Hundreds of startups have tried their luck around the globe, but those 3 front runners have the most funding and best growth strategies.

Klarna vs Affirm vs Afterpay

Each of the front runners approach their go to market strategies in a different way.

Affirm has invested in strong partnerships early and powers Shopify’s Shop Pay since July 2020 and Amazon’s BNPL service since November 2021. [2]

Afterpay was acquired by Block in January 2022 and profits from its established ecosystem. Block owns point of sale provider Square, consumer payment app Cash App, and music platform Tidal. That provides a strong basis to tap into Block’s merchant network and Cash App’s consumer network and tie the two with one BNPL solution together.

Interestingly, all three companies have roughly the same amount of organic traffic right now:

Klarna: 1.1M monthly visitors, 60K non-branded

Affirm: 1.1M monthly visitors, 68K non-branded

Afterpay: 1.2M monthly visitors, 42K non-branded

All 3 built out a directory on their sites that allows consumers to explore brands that provide BNPL in different categories.

The idea is to rank for “{brand} bnpl” terms like “Walmart bnpl” or “Walmart buy now pay later”, which have grown a lot in demand over the last two years, and meet customers when they’re interested in purchasing from a specific brand.

Those directories, a classic aggregator play, bring in half of all non-branded traffic. The play scales with more brands that come on board, which could support the BNPL flywheel dynamic.

Growth dynamics for BNPL

BNPL providers are marketplaces between consumers and merchants. They face the classic marketplace problem that Andrew Chen termed the cold start problem: in order to attract one side of the market, the company needs to build the other side. In other words, to drive more merchants, BNPL providers need to show strong consumer base, which in return is mostly attracted through a good selection of merchants.

This is the flywheel dynamic for BNPL providers: more merchants equal more consumers and vice versa. Affirm was smart to build partnerships early and establish a good base of merchants. In the same realm, Block’s acquisition of Afterpay makes sense. Klarna drives more consumers through price comparison (they also have the biggest consumer base already).

The second way to grow for BNPL companies is through more spending. BNPL companies spend a lot of money on ad campaigns that inspire consumers to purchase. I see Afterpay’s integration with Cash App as one big milestone for Block here.

The third growth dynamic is the data BNPL providers get through their apps/browser extensions. Remember, consumers need to use the apps to pay but they can also use them to find new merchants and products in general. By providing a product catalogue in their apps, BNPL providers gather customer data that they can use to make product suggestions that fit to customers’ spend profile and credibility.

The most important growth dynamic, however, is the integration with merchant check out flows. Having your logo next to a merchant’s add to bag or pay button is the most efficient way to get attention and awareness.