SEO traffic shows FTX never stood a chance

The $80 billion crypto exchange FTX and its founder Sam Bankman Fried (often referred to as “SBF”) caused quite the scene when its fraudulent house of cards fell apart. The meltdown had fatal consequences for the crypto market, which inflated from a peak value of $2.9T down to under one trillion USD (source). At least one billion in FTX’s client funds are missing.

Some say the failure of FTX was predictable based on how it operated. I think the downfall of FTX was indeed predictable, but more so based on FTX’s SEO performance.

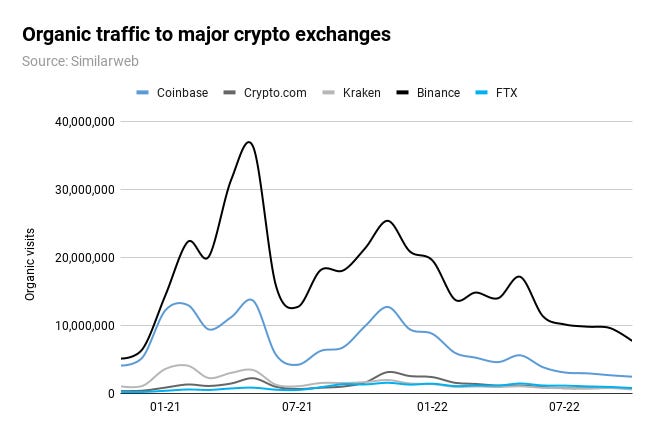

FTX.com always lagged far behind other major crypto exchanges like Kraken, Binance, Crypto.com and Coinbase. For example, searches for “crypto” saw a massive spike in May 2021 when many cryptocurrency prices crashed. At the time, Binance got 36.3M monthly visits, Coinbase 13.6M, Kraken 3.4M, Crypto.com 2.2M and FTX 810K. In other words, Binance had 44x as much organic traffic as FTX.

In a market where SEO drives 40-60% of customers, it’s crucial to do well. It’s doubtful FTX could have been competitive even without the fraud.

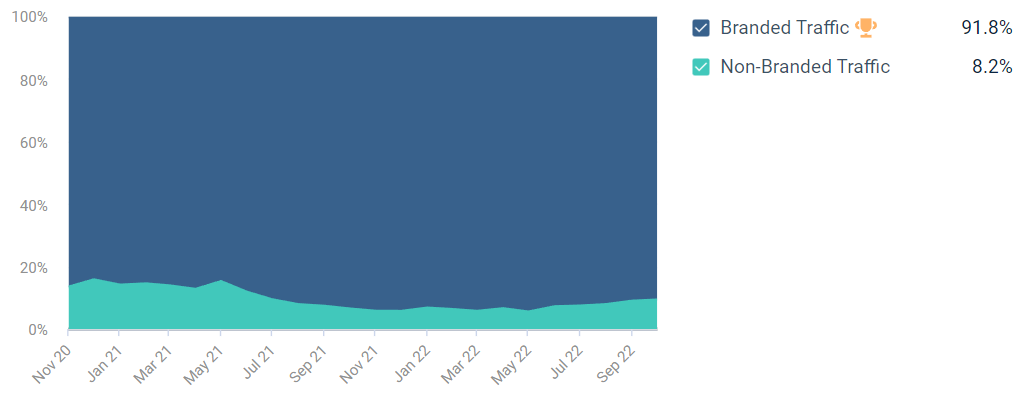

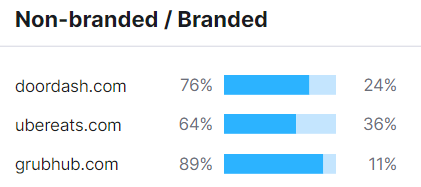

Besides the sheer organic traffic, a second marker for the competitiveness of marketplaces is the share of nonbranded traffic. That’s where the market is won because users are undecided when looking for related but unbranded terms. 92% of FTX’s organic traffic was branded (see screenshot below). For comparison, 17.1% of Binance’s organic traffic is unbranded, 22.3% of Kraken’s and 25% of Coinbase’s.

The crypto game has now become a race between the three largest remaining exchanges: Binance, Coinbase, and Kraken.

Binance vs. Coinbase vs. Kraken

When markets mature, they tend to have two strong contenders and a few smaller ones. For example, Uber and Lyft dominate the ride-hailing market, while smaller contenders like Via, Didi and Grab compete for smaller (cities) or other markets (geo areas).

After FTX’s meltdown, the logical question is which exchanges will dominate crypto. The answer: most likely Binance and Coinbase.

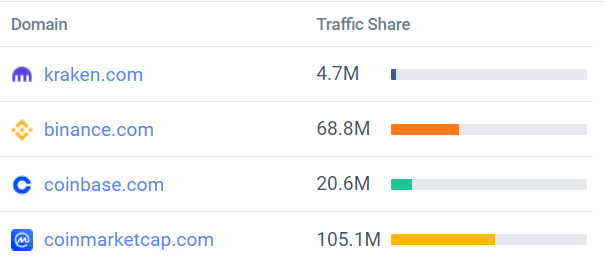

Binance has by far the most traffic but also acquired the crypto tracking tool coinmarketcap.com in March 2020. The site has more organic traffic than Binance, Coinbase, and Kraken combined. Owning more surfaces and touchpoints in the crypto space allows Binance to better understand market and consumer behavior trends.

Binance has 3x the organic traffic as Coinbase but only 2x as much non-branded traffic. Getting the SEO advantage can be a lever for Coinbase. According to Semrush, binance.com ranks for 7,100 non-branded keywords in the US top 3, while coinbase.com has 47,100.

Remember, SEO is a zero-sum game, meaning there is only one winner for every keyword. Gaining the upper hand in SEO can mean forcing your rival to spend more on advertising, which is not ideal in a down market.

Another potential advantage for Coinbase is geo dominance. Binance dominates regions outside the US, the largest consumer economy in the world, based on brand search volume.

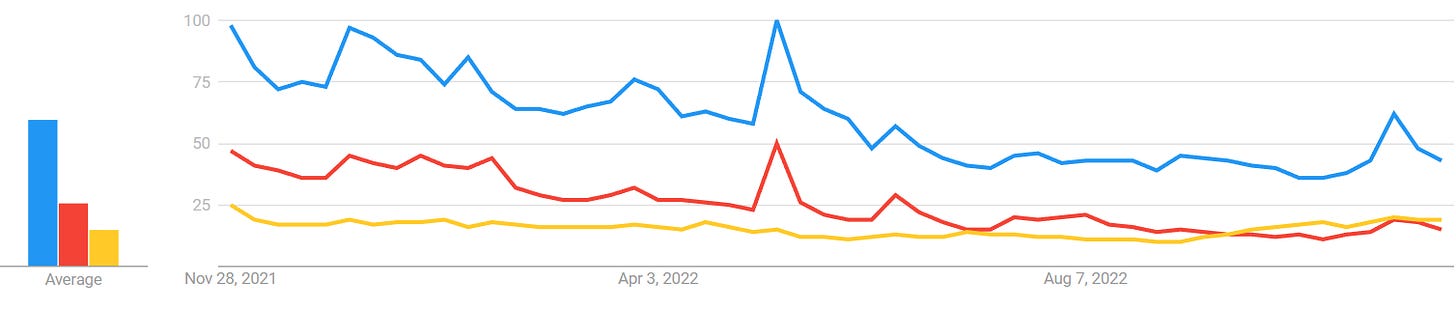

In September 2022, searches for “kraken” surpassed “coinbase” globally (screenshot below) and “binance” in the US. Though the smallest contender, Kraken can compete with Coinbase for certain markets.

Applying the framework to food delivery

The FTX case brings up the question of what other markets we can evaluate through the same lens. Are there markets that show a similar connection between market leadership and SEO performance?

If FTX serves as a precedent, we should see food delivery platforms with a high market share also have:

High total organic traffic

High nonbranded traffic

Dominating brand search volume across many geo regions

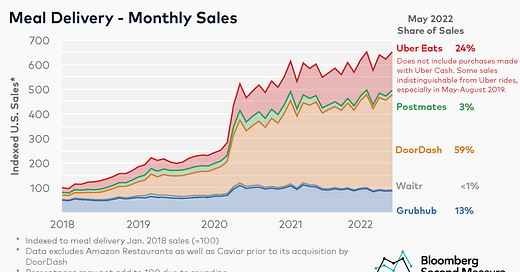

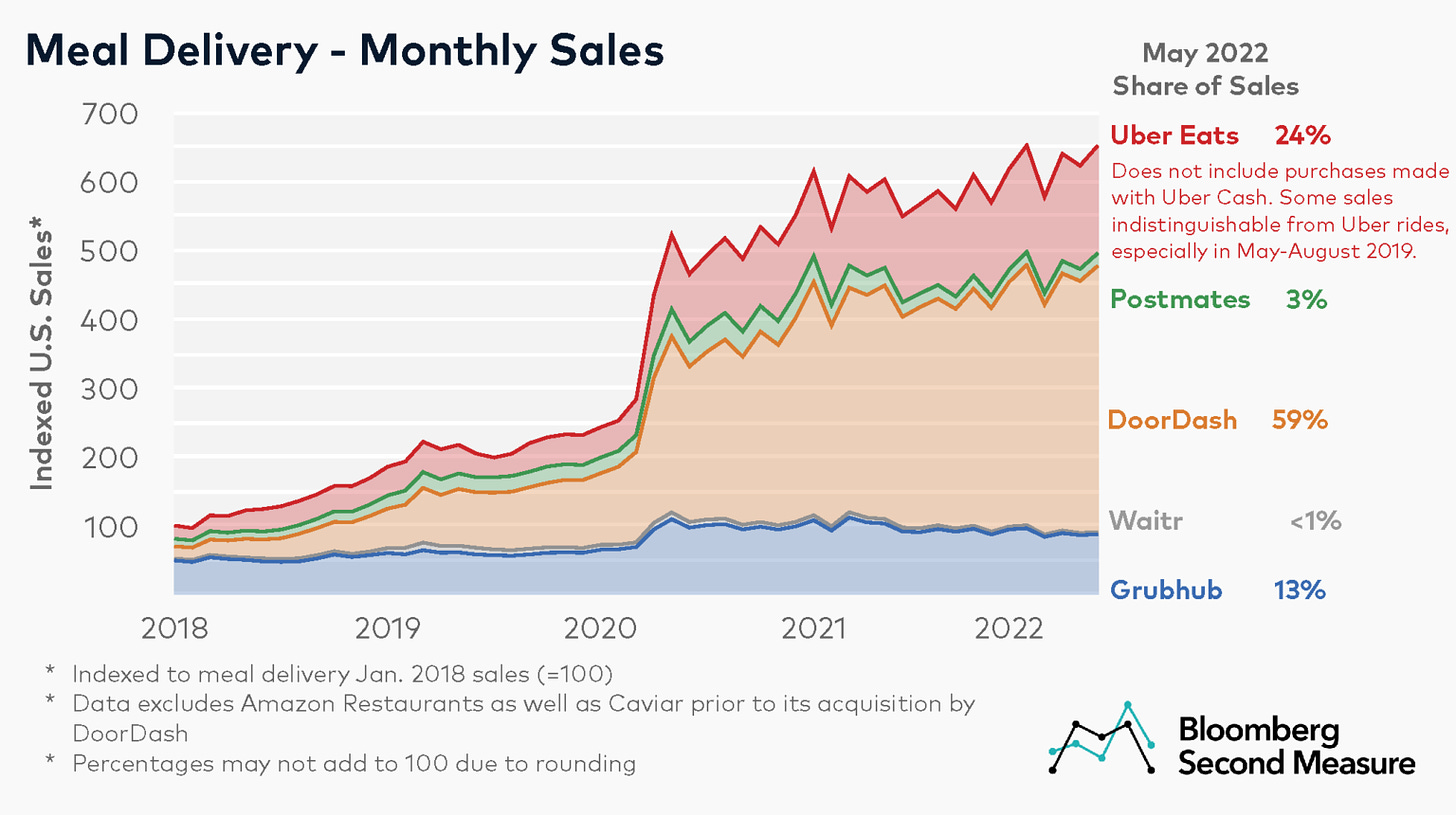

To test the hypothesis, I looked at the 3 biggest players in the food delivery market, which is set to hit $432b by 2030 (source). Doordash owns 59% market share, followed by Uber Eats with 24% and Grubhub with 13%.

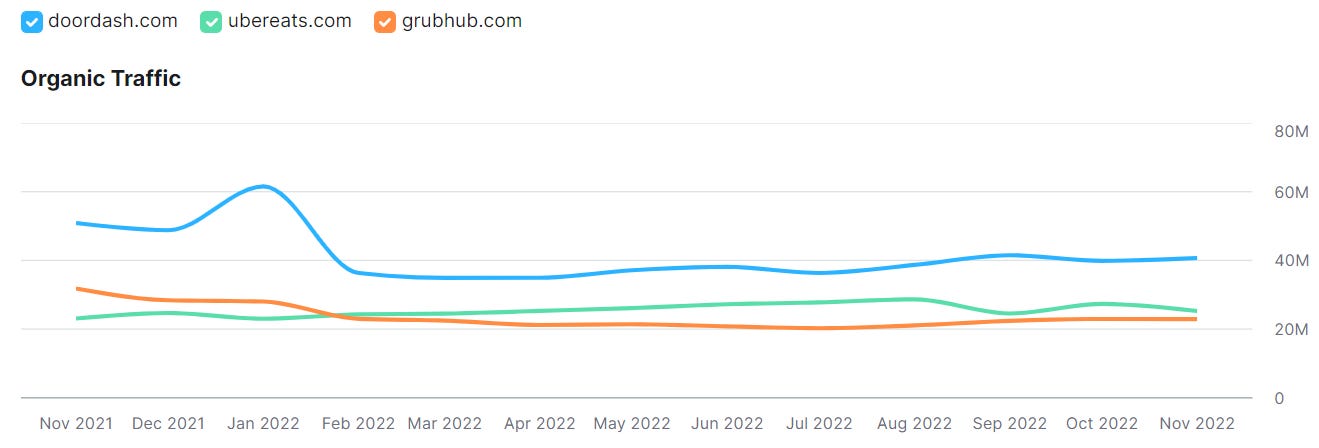

That same trend is reflected in global organic traffic: Doordash leads with 40.7M monthly visitors, followed by Uber Eats with 25.3M and Grubhub with 22.9M.

Organic traffic share between Uber Eats and Grubhub is much closer than market share. In fact, Uber Eats surpassed Grubhub’s organic traffic in January 2022, likely due to better non-branded keyword performance.

Doordash gets about 9.7M, Uber Eats 9.1M and Grubhub 2.5M nonbranded visitors a month.

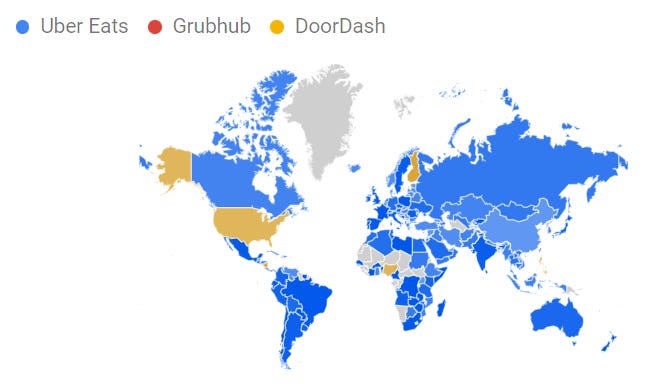

Other than Binance, Doordash does not win the most global regions by brand search volume - only the US. The brand being searched for in most global regions is Uber Eats, likely due to its global ride-hailing app.

Concluding, two out of 3 markers correlate with market leadership: high total organic traffic and a high share of nonbranded traffic.

Predicting market leaders based on SEO performance

SEO can be an indicator of the overall performance of marketplaces because it’s such a critical channel for them, but marketers need to be cautious. Many factors, like business or monetization models, influence which player “wins” a market.

In FTX’s case, branded traffic had a very high share, brand searches didn’t dominate in any global region, and total traffic was subpar to competitors. These markers alone could have predicted the company would get in trouble, but fraud took care of that.