Growth Intelligence Brief #12

Explaining the AI hype and how it carries over to SEO, how Google wins with Gemini and what it means for marketers, how OpenAI plans to strike back and the top winner / loser sites from 2025.

Welcome to another Growth Intelligence Brief, where organic growth leaders discover what matters - getting insights into the bigger picture and guidance on how to stay ahead of the competition.

As a free subscriber, you’re getting the first big story. Premium subscribers get the whole brief.

Today’s Growth Intelligence Brief went out to 506 (+29) marketing leaders.

AI isn’t collapsing search. It’s stressing the whole ecosystem.

This brief covers 3 pressure points:

Capital is flowing faster than AI revenues can justify

Google continues to capture most discovery and dollars

High-intent queries are shifting while routine search stays put

The implication: uneven disruption, not a clean handover. Let’s take a closer look.

Is the AI bubble going to burst?

It’s not just AI Visibility tools. AI hype is everywhere.

Here’s what happened:

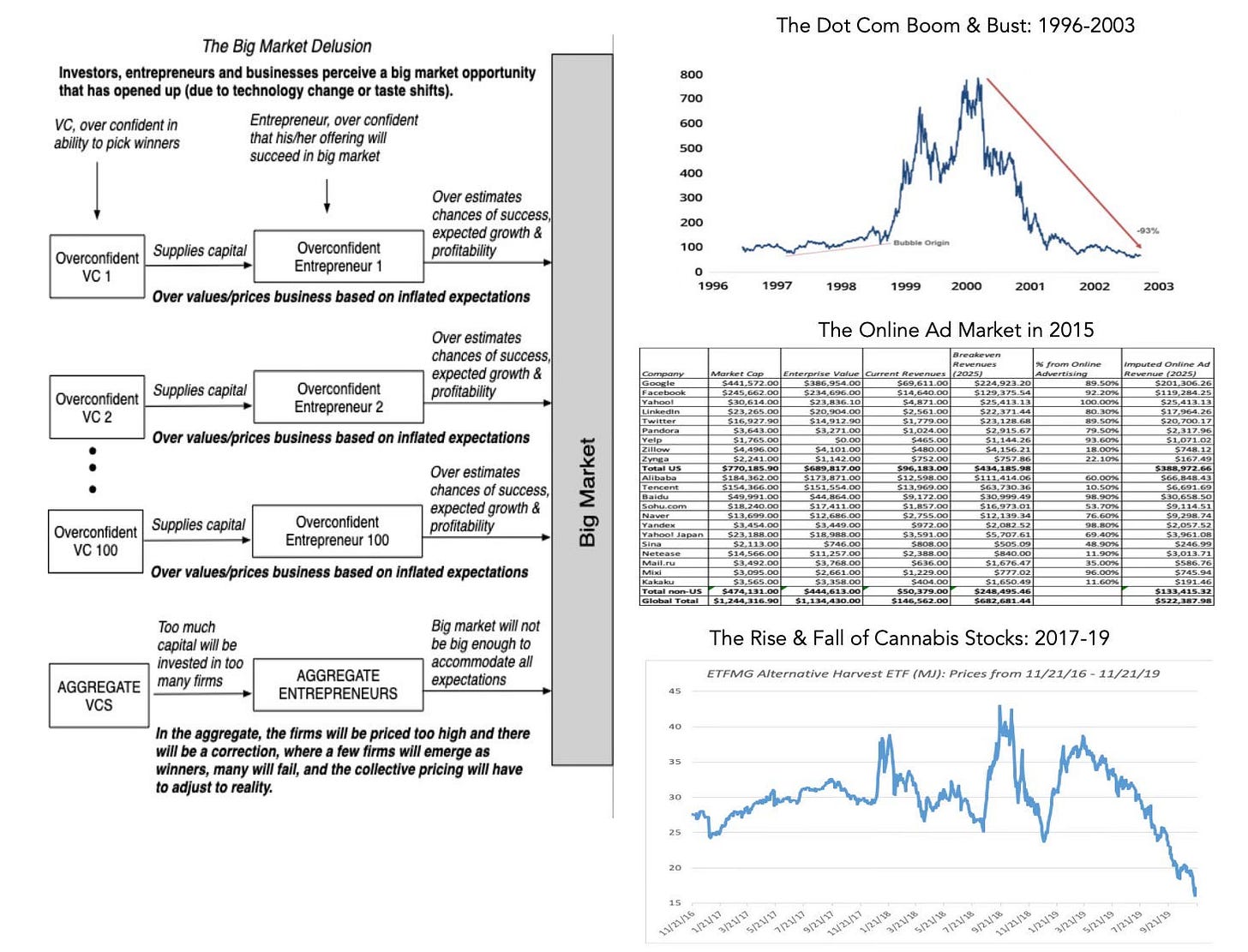

Aswath Damodaran, Professor of Finance at Stern, looked at the combined valuations of the major LLM players (OpenAI, Anthropic, xAI and others) and noted that investors have priced them at roughly $1.5 trillion despite collective revenues well under $100 billion.

He reverse‑engineers the revenue a company would need to justify a $5 trillion market cap and shows that even with today’s high margins, an AI firm would need $590 billion to $677 billion in annual revenue to break even.

He then applies a 3‑part test (possible, plausible, and probable) to decide whether those breakeven revenues can realistically be reached.

Finally, he warns that investors may be falling prey to a big‑market delusion, where each company’s revenue projections could make sense individually but in aggregate exceed the total size of the AI market.

Why this news matters:

Funding and executive attention follow valuations. If expectations are detached from reality, capital could dry up quickly when results disappoint. You should be mindful that only a handful of model providers are likely to justify their current prices; others may merge, pivot or disappear. The sector’s growth is real, but it’s neither infinite nor evenly distributed.

My take on this:

We all wonder why there’s so much hype around AI Visibility tracking, but there’s so much hype around… anything AI. You can trace it all the way back to billions in capex and circular deals.

Here’s what to do:

As marketers, our role is to cut through the noise:

Judge whether an AI visibility product truly makes sense

Shape the right internal narrative (caution, but don’t kill the excitement)

Avoid jumping on every new bandwagon